How to File Returns for Housing Levy

The housing levy, a mandatory contribution for both employees and employers at a rate of 1.5%, has become effective following the lifting of the suspension of the Finance Bill 2023 by the courts. As of this August, it's required for both employees and employers to be well-versed in the process of filing returns for this levy. In this article, we'll guide you through the steps to ensure a seamless filing experience and compliance with this new law.

- Understanding the Basics of the Housing Levy:

The housing levy, set at a rate of 1.5%, is a mandatory contribution by both employees and employers. This contribution aims to support the government's Affordable Housing Program, which seeks to make housing more accessible and affordable for Kenyan citizens.

- Effective Date and Backdating:

Starting from this August's payroll, the housing levy is set to take effect. However, it's important to note that the levy has been backdated for July salaries. This means that you'll need to include the housing levy for July in your filing process as well.

- Due Date and Collecting Agent:

The due date for filing housing levy returns is 9 days after the beginning of every month. This gives you a reasonable window to compile and submit the necessary information. The Kenya Revenue Authority (KRA) serves as the collecting agent for the housing levy, ensuring that the contributions are efficiently collected.

- Filing Process:

Filing returns for the housing levy involves incorporating the relevant details into your PAYE filing process. Here's a step-by-step breakdown of how to do it:

Step 1: Download the P10 Excel Sheet from iTax: Access the P10 excel sheet on the iTax platform. This sheet provides a comprehensive template for filing various aspects of payroll, including the housing levy.

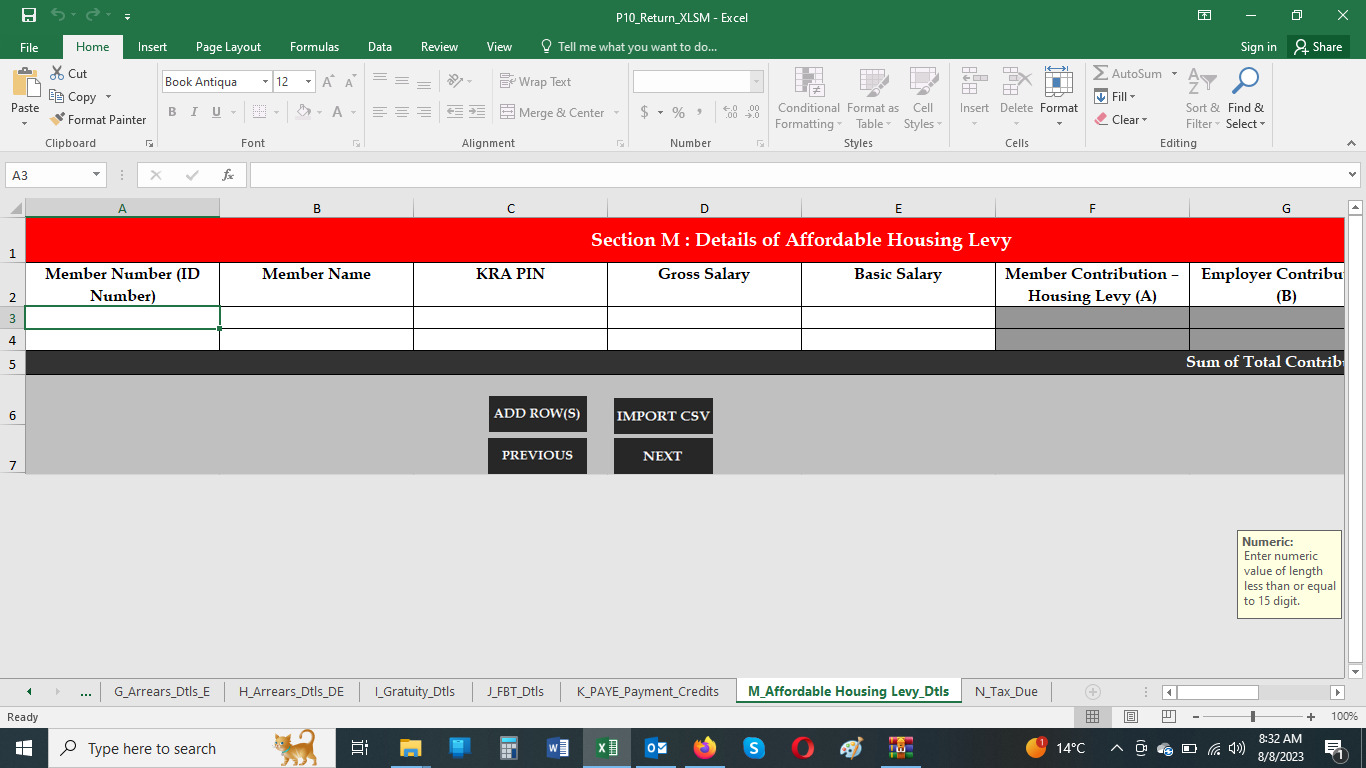

Step 2: Fill in Employee Details: On the P10 excel sheet, locate the 'M' sheet designated for Affordable Housing Levy. Input the following details for each employee:

- Identity Number (ID Number)

- Employee Name

- KRA PIN

- Gross Salary

- Basic Salary

- Employee Contributions

- Employer Contribution

Alternatively, you have the option to import a CSV file containing the above-mentioned details for each employee. FaidiHR has an already pre-populated CSV file with all the essential columns. This CSV file can be obtained at faidihr.com, or you can book a free demo at: https://faidihr.com/demo/requestdemo to be guided by our team of experts.

Step 3: Validate and Upload: Once you've filled in all the required information, ensure that the P10 Excel sheet is accurately completed. Validate the data to ensure its accuracy. After validation, upload the P10 Excel sheet to the iTax portal.

Final Thoughts:

Filing returns for the housing levy is a crucial responsibility for both employees and employers. By following the steps outlined above, you can ensure that you meet your obligations in a timely and accurate manner.

Incorporating this new requirement into your payroll process might seem daunting initially, but with the right guidance and understanding, the process becomes much smoother. As you navigate this change, in case of any challenges, our team at FaidiHR is ready to help. Call/WhatsApp us at 0714004596. Email us via info@faidihr.com.