Specifications for new NSSF Returns file structure

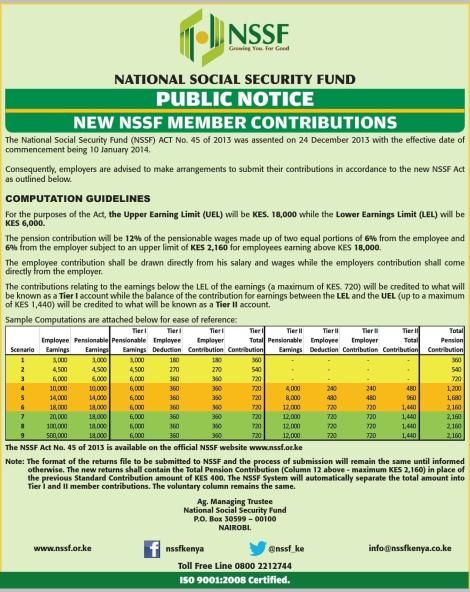

Following the implementation of the NSSF Act 2013 (Act 45 of 2013 Laws of Kenya) the format of the returns to be submitted to NSSF have been changed to enable Employers and NSSF capture more details of the wider variety of Pension Contributions. The new file will be submitted in the form of a Microsoft Excel file in the format described in this document. It will have two components, a header and a details component.

The sample return file above contains returns for an employer with 4 employees, two of whom have three contribution types each. That the Return file ends at the Total Column L while the comments column has only been included for explanation purposes.

The identifier fields should all be formatted as “Text” to allow for leading “Zeros” e.g. Returns Type “02”or NSSF Number “0001234567”.

The Number values should be rounded UPWARDS to the nearest Shilling and should NOT be formatted with commas separating Thousands. e.g. “1,000,000” is not allowed.

The Total Row should be deleted.

Fields in Header Section

The header will consist of the common information to identify the employer and aggregate information to enable automated error checking.

The header rows will start from Cell A1 to B10 with the cells in the first column containing a descriptor while the second column will contain

the actual values as elaborated here.

The details body will start with a header row (at row 12) separated by ONE blank row (row 11) from the header.

The actual submission details will start from row 13. Each employee will have at least one entry (row) for each of the Contribution Type (column G).

The actual number of rows per each individual employee will depend on the actual number of Contribution Types they qualify for.

Column A to F will contain the identification details of the individual member and MUST be repeated for every row for that particular member.

PERMITTED VALUES FOR FILE RETURNS TYPE (CELL B1)

There shall be three different types of Returns depending on the data being submitted as follows:

RETURNS TYPE CONTENTS

- This will be the Regular Employees Returns File created after the payroll run.

- One for each month per employer

- Only Contribution types 101, 102, 103 and 105 are allowed

- Only Income Type 1 & 2 are allowed

- For making submissions for special category of Daily paid Workers

- Only allowed for Contribution Type 104 and Income Type 3

- For declaring Tier II contributions to a Third Party “Contracted Out” scheme

- For compliance reporting purposes only.

- Not to be accompanied by any payment into NSSF.

- Only Contribution Type 200 and Income Type 1 & 2 allowed

- To be submitted monthly along with Returns Type 01 for Contribution Type 101

- For the previous RETURNS type 01, the CONTRIBUTION TYPES 104 and 200 will not be permitted. For RETURNS type 01 the

CONTRIBUTION TYPES 101, 102, 103 and 105 will be allowed.

Note: In case some members have been left out of any Returns type, for whatever reasons, a separate file of the same Returns Type and period should be submitted. All submissions following the primary submission of any Returns type shall be treated as supplementary. Should the member be also included in the primary returns file, his contributions will be treated as Income Type 2. Subsequently, any employer may submit multiple files per Return type in one month.

PERMITTED VALUES FOR CONTRIBUTION TYPE (COLUMN G)

The Contribution Type column will be used to indicate the type of contribution contained in that particular row. It will determine the computation and validation rules to be applied in arriving at the Member and Employer contribution figures. It shall also determine the member NSSF account to which the contribution amounts will be credited to.

PERMITTED VALUES FOR CONTRIBUTION TYPE (COLUMN I)

The Income Type column will be used to indicate the type of earnings for the employee. It will be use, together with the contribution type, to determine the computation and validation rules for the contributions.

Find out more

Experiencing any challenges adjusting to this new NSSF Rates? Get us here or hit us up on 0746428844 or email info@faidihr.com to get set up today.